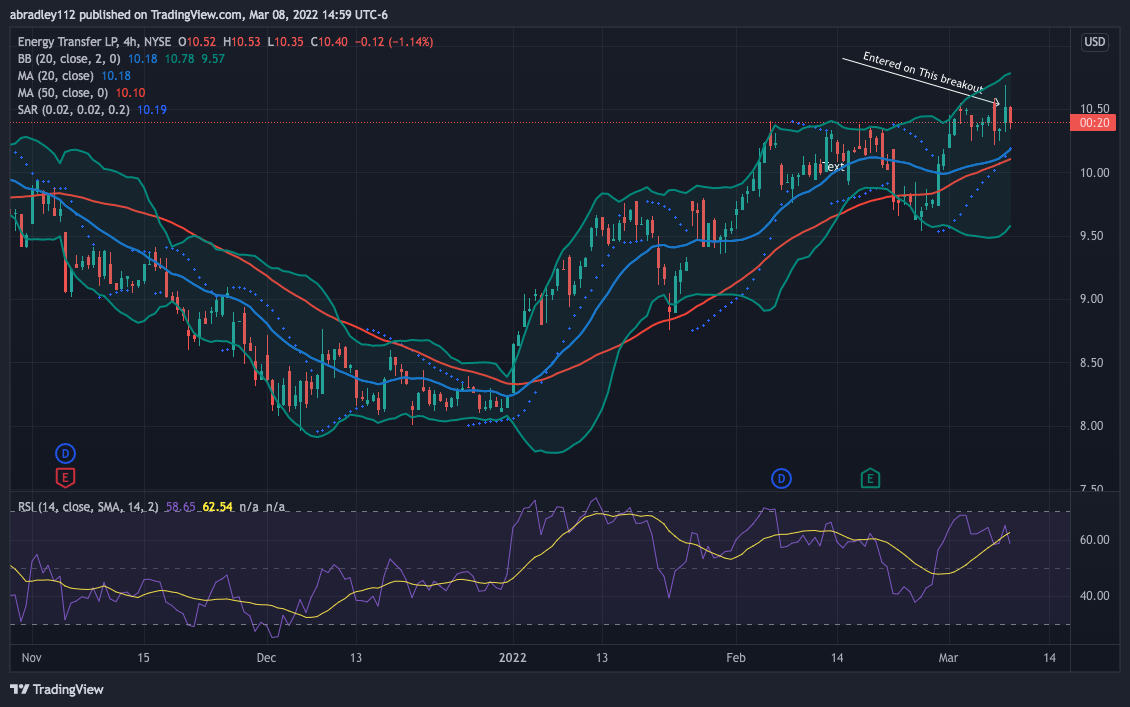

Going through my analysis this morning, FT was one of the few that looked like they’d be worth pursuing today. Price had been pushing up for multiple months, based for a few days, and pushed out of the highs of the base.

There was a little there that gave me pause (see 3/8 Journal), but there were more positives than negatives, so I took the shot. My order filled almost immediately at $.88

I didn’t get to this as it happened, I went to the gym first, but looking at it now an hour later, and price has pulled back to within that range. I’m still in the position, but I’ll get out if price breaks below the lows of the base, and I’ll revisit Friday if nothing has happened by then.

Underlying Price – $10.63

Underlying Target – $11.00

Strike Price – $10.00

Premium – $0.93

Delta – 0.23

Exit – 0.36

I exited this position on 3/14 — which was the Monday after the Friday I mentioned above — for $.36. Not a full position loss, but still a loss. No big deal, just mentioning it. Price pushed down, and I considered my pain-point to be $10 and while it had gapped below that by Monday morning, I still got out with a market order. Looking today, 2 week later, and it’s a little above $10, so overall, I’d call it a solid trade right within my parameters and despite the loss, I did the right things