Happy Wednesday everybody and welcome to my investing blog. This is where I share my moves in the market and talk about the performance of those moves.

Over the past couple of years, I’ve solely been focused on maintaining my long-term portfolio. I’ve been itching to get back in to trading, but I think I need to save up a little more before I do so. I’m getting there.

In the meantime, though, I put together 18 ETFs across varying sectors with the goal of maintaining pace with (or even beat) the market in good times; and to not suffer as bad of losses as the market during downturns. Check out the portfolio page if you want more info on the ETFs and why I chose them.

Monthly Performance

Over the last month (between February 3rd and March 3rd) the portfolio was down a little under 2%. This was better than the S&P, DOW, and NASDAQ, which lost 3%, 3%, and 6.5% respectively.

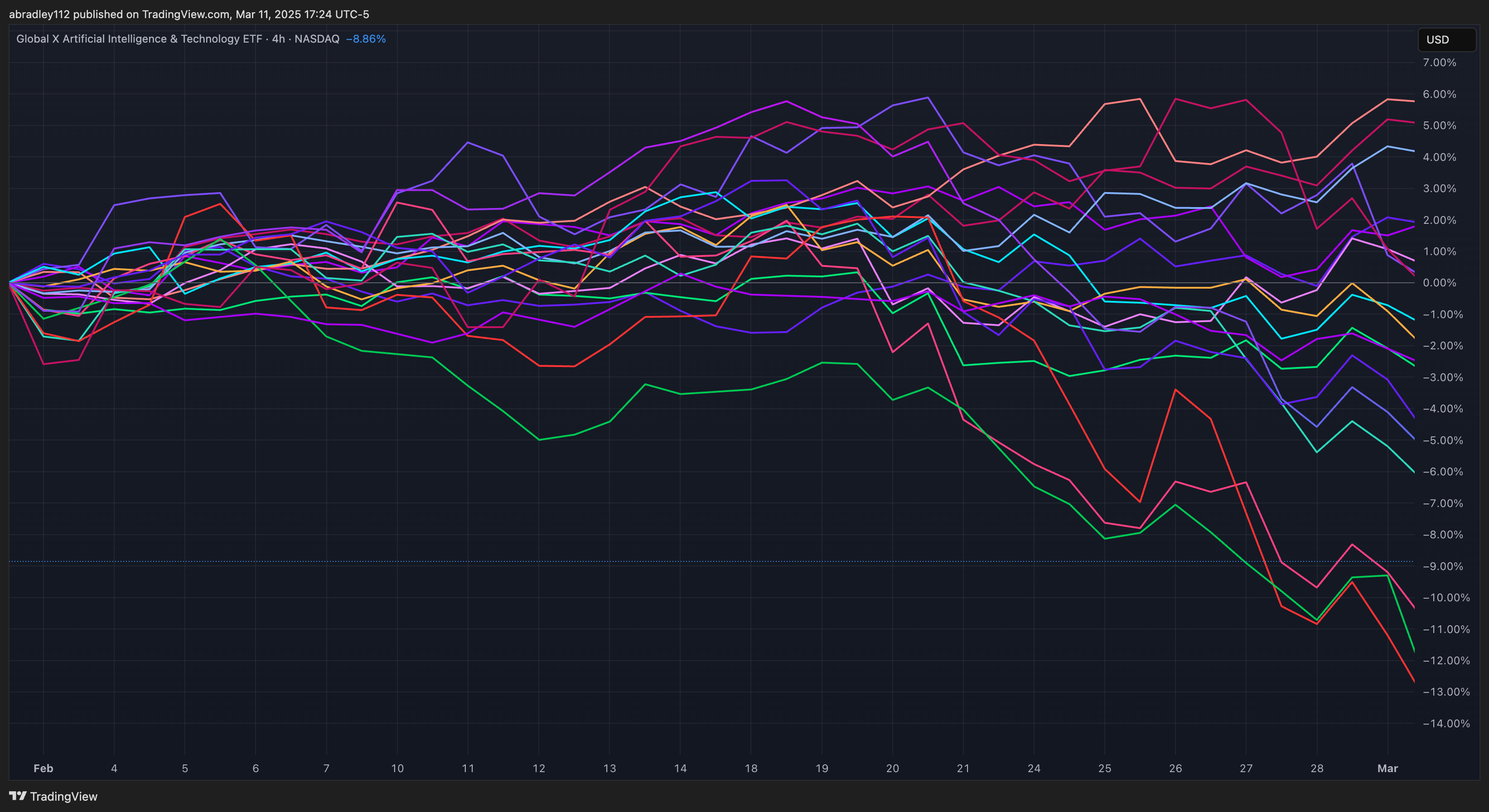

The decline was largely due to PSI which lost 11.5% and PSCT which lost 11%. These were both technology stocks (small-cap tech companies & semiconductors), and given the fact that tech stocks across the board have taken a huge hit, it makes sense.

XLP and XLRE (consumer staples & commercial real estate) each gained a little over 5% over the past month, which were the best performers.

Year-to-Date Performance

Since the start of the new year, this portfolio has gained about 2% which is slightly outpacing the DOW at 1.8%, and more-greatly outpacing the S&P and NASDAQ. The S&P is almost even on the year (lost 1/3 of a percent), but the NASDAQ is down nearly 5%. The tech stocks in my portfolio are also taking the biggest hit, which is why I’m glad I’m diversified.

I’ve said that the point of the portfolio is to maintain/outperform in down markets so I don’t suffer too badly, and as of right now, that seems to be happening. It’s too early to call this a down-market overall, though, so time will tell, but I’m satisfied with how things are going right now.

Conclusion

Beating the market feels good, even if I was down a little as well. Gotta look at the positives. On top of that, I’m up on the year, and am well above the NASDAQ. Given the dips in the market, too, I’m looking forward to adding a good amount to the portfolio.

Thanks for reading! Let me know in the comments how your portfolio is doing and how it compares to the market. And if you have any questions, let me know, I’m happy to clarify anything that might not make sense here. I’m here to help and learn together, so let’s collaborate!

Unless something changes, my next post should be in early April, where I give a quarterly update and add more dollars to the portfolio. So, make sure to check back for that!