Welcome to my trading and investing blog. This is where I share — well, lately, this is where I share my portfolio and it’s percentage changes over the last month/quarter/year. I have in the past, and plan to in the future, do more active trading and talking about that. But right now my portfolio is the only thing I’m focused on in the markets.

The Portfolio

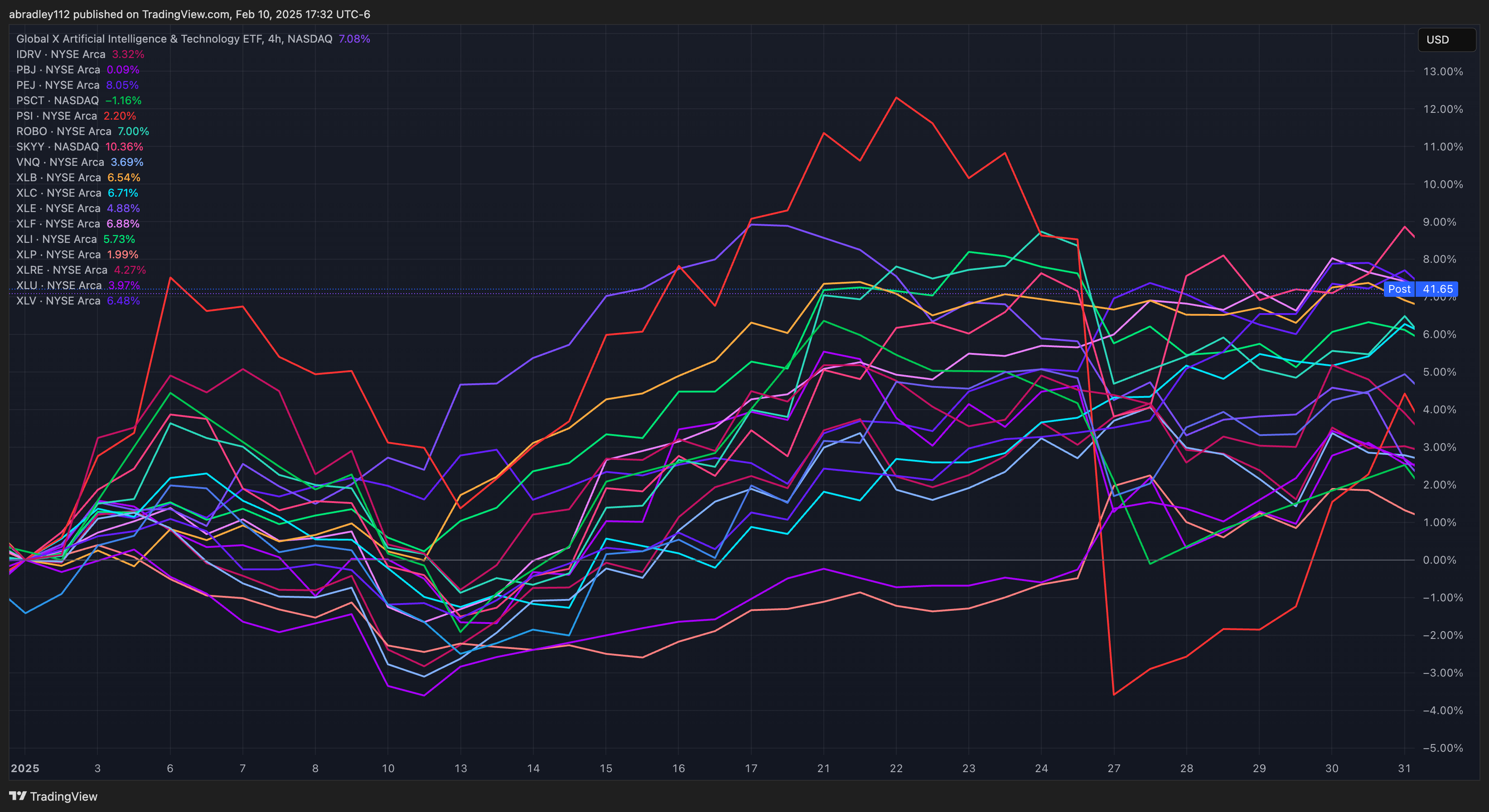

In total, it consists of 18 ETFs across various sectors, in order to be relatively well diversified. I chose them with several things in mind: growth during strong market environments, enduring market downturns, and to be invested early in up-and-coming sectors.

I chose the ratios with a mind toward that, and picked the ETFs based on volume. As something long-term, I wanted stable ETFs to invest in. Now that I’m thinking about it, too, there may have been cases where I chose a “second choice” ETF when I couldn’t afford the one I wanted, so that I could still get in to the sector right away. And truthfully, there may be better-performing ETFs in some of these sectors. Maybe an audit is due. I’ll have to create a plan and a criteria before I do that though.

A Quick Note

I built a calculator to keep track of the ratios of each security; and in that calculator, I also track the portfolio’s performance. When I made my last post, I noticed an slight oversight with one of my calculations, though. I was only taking into account the ending weight when comparing a time period, not the starting weight.

To be more specific, my “Overall” calculation — how the portfolio has performed since it’s inception — didn’t have the exact original ratio of each ETF. I’ve done my best to maintain the ratios, but I give myself about a 1% buffer in either direction, so they’ve varied over time. Only looking at the ending percentages doesn’t quite give an accurate picture.

I used a calculation* I found and while it’s not wrong I think it could be better. The original calculation would make sense if the ratios are maintained exactly, but as I’ve mentioned, that’s not the case. I think Schwab’s calculation makes more sense, and get’s to a more accurate number, so I’ve updated my calculators to use this new formula.

*Here’s the link to the calculation: https://www.fortunebuilders.com/how-to-calculate-portfolio-return/ But at the time of publishing this post, it’s dead. You may be able to find an archived version, though.

Actually, this post took an extra few hours because I was building said calculators. Initially I was going to just use Schwab’s number, but the data there only goes back to May of last year when my account was migrated over from TD Ameritrade 🙄. In order to get the full picture and the whole number, I had to make it myself. Also, in the future if something were to happen where the account exchanges hands again, at least I have all of the data and calculations setup in my own personal doc.

I’ll still use the original calculation for both the monthly changes (especially when I don’t add any more money) and to show the weighted percentage change of each individual ETF. There may be a way to drill down to the individual ETF level with this calculation, but it’s something I’ll have to work on in my head. And for the purposes of this blog, I’m happy with the current numbers.

Let me know in the comments if you’re interested in my calculator/tracker by the way. I might offer it up if there’s enough interest.

Changes

Between the first trading day and the last trading day in January (1/2 – 1/31), my portfolio had an increase of 4%, compared to a 2.78% increase in the S&P. I’m slightly outpacing it right now, but, really, I’m basically in lock-step with it.

Since inception, using the new calculation, the time-weighted return of my portfolio is 34.5%. The S&P, over the same period is up 58%, and the DOW is up 44%. I’m lagging the market overall, but (as I’ve mentioned before) this portfolio hasn’t been tested in a true down-market environment. If I’m planning on holding this portfolio for many years, it’s technically still pretty “young”, so I’m not jumping to many conclusions just from these numbers.

Additionally, some of the ETFs are specifically in sectors that I don’t expect to start to perform for several years (like self-driving cars and robotics) so they’re naturally going to hold down the portfolio a bit right now. The fact that I am relatively on-par with the market overall is a big win.

Like I mentioned, maybe an audit is due — see if there are better-performing ETFs in each sector — but I don’t want to make any rash moves. So for now, I’m going to leave it be; check in next month; and add more dollars to the fund in April. Make sure to keep checking back to see how it continues to perform!

Conclusion

Overall, I’d say the portfolio is in a great spot. I’m making money, and it technically beat the market last month. We’ll see what the future holds, I’m going to try to stay positive either way. If it grows, fantastic, if it falls, well, that’s opportunity to add more to the fund. Win-win.

Thanks for reading! Let me know in the comments what you think about this portfolio — if you think there are better ETF options out there or if I could improve it in any way. Or, let me know how your portfolio is going; I’m here so we can learn and grow together!

See you soon