Welcome to my investing — soon to be investing and trading — blog. I haven’t been trading much over the last year, but I’m still maintaining my long-term portfolio.

The Portfolio

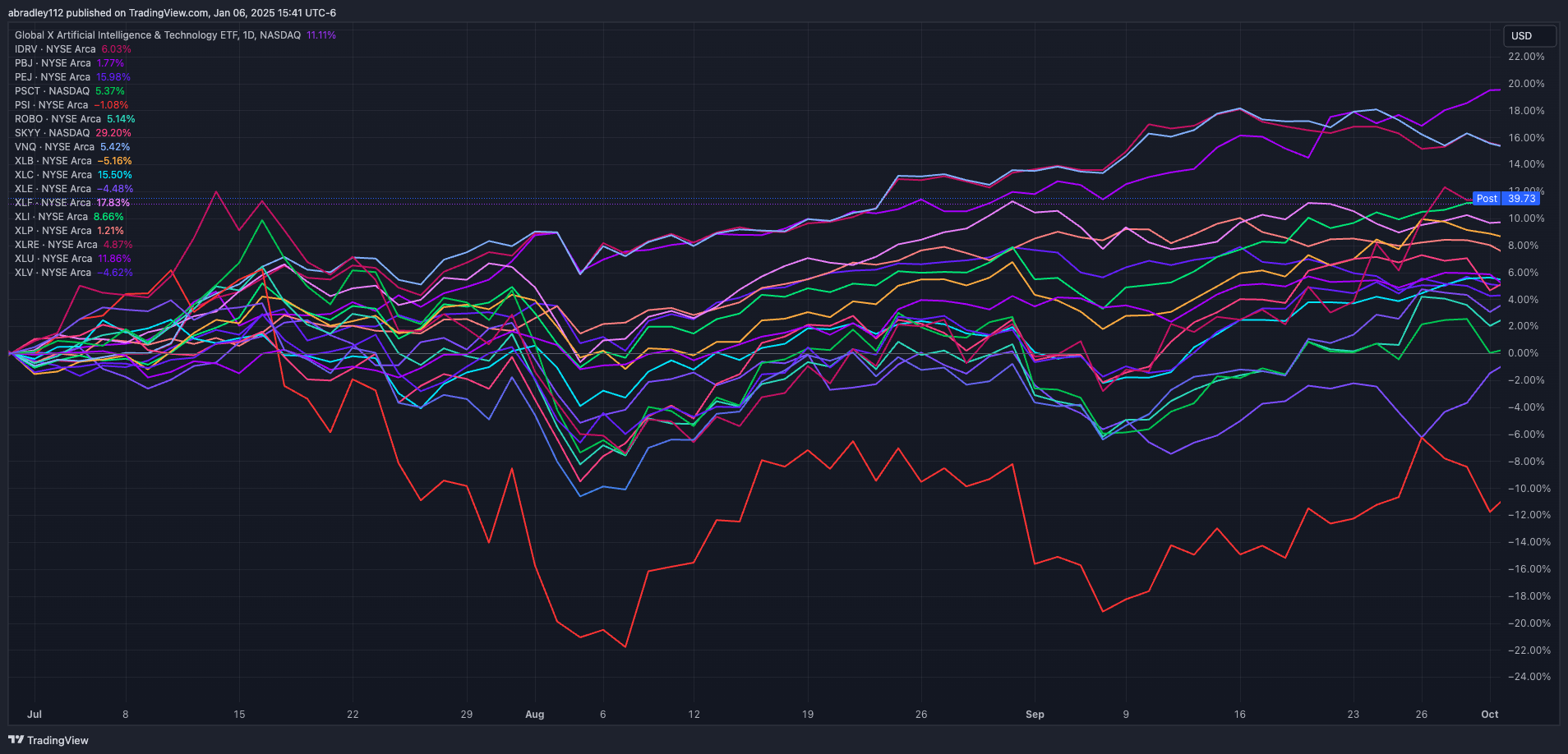

I chose 18 ETFs and gave them each a weight (based on how risk-averse and future-minded I wanted the portfolio to be); and I built a calculator to maintain the ratios and calculate the changes each quarter. Here are those securities and their percentages:

Read on to see how the portfolio changed in Q3 2024.

Quarter Over Quarter Percentage Changes

The market overall remained relatively steady, increasing another 4% (same as the prior quarter) for the quarter, and increasing to 49% overall. My portfolio outpaced the S&P over these last three months, though, increasing 7.8%. Overall, it’s still under the market, at only 30.3%, but still doing well.

I was able to add a little more than usual to the portfolio this quarter, so even with the gains I added a few more shares to the fund. This time I added more IDRV, PBJ, PEJ, XLB and XLE.

Conclusion

I’ve said it in the past that I’m not expecting to outperform the market; but it’s nice when I do — and I can’t say I’m not hopeful for more of the same. I’m realistic though and know that there will also be times where I don’t, I just have to be consistent and maintain my resolve in downtimes. Truthfully, that’s where the largest gains are ultimately going to come from.

Thanks for reading! If you’ve got any questions about my portfolio, or any thoughts on it let me know in the comments! I don’t pretend to be an expert, I’m just acting on what I’ve read, so I appreciate feedback. Let’s learn together!