Welcome to my investing (and future-trading (not to be confused with futures trading)) blog. This is where I share my thoughts and moves within various financial markets. Lately, I haven’t really been trading, instead just monitoring and maintaining a long-term portfolio.

The Portfolio

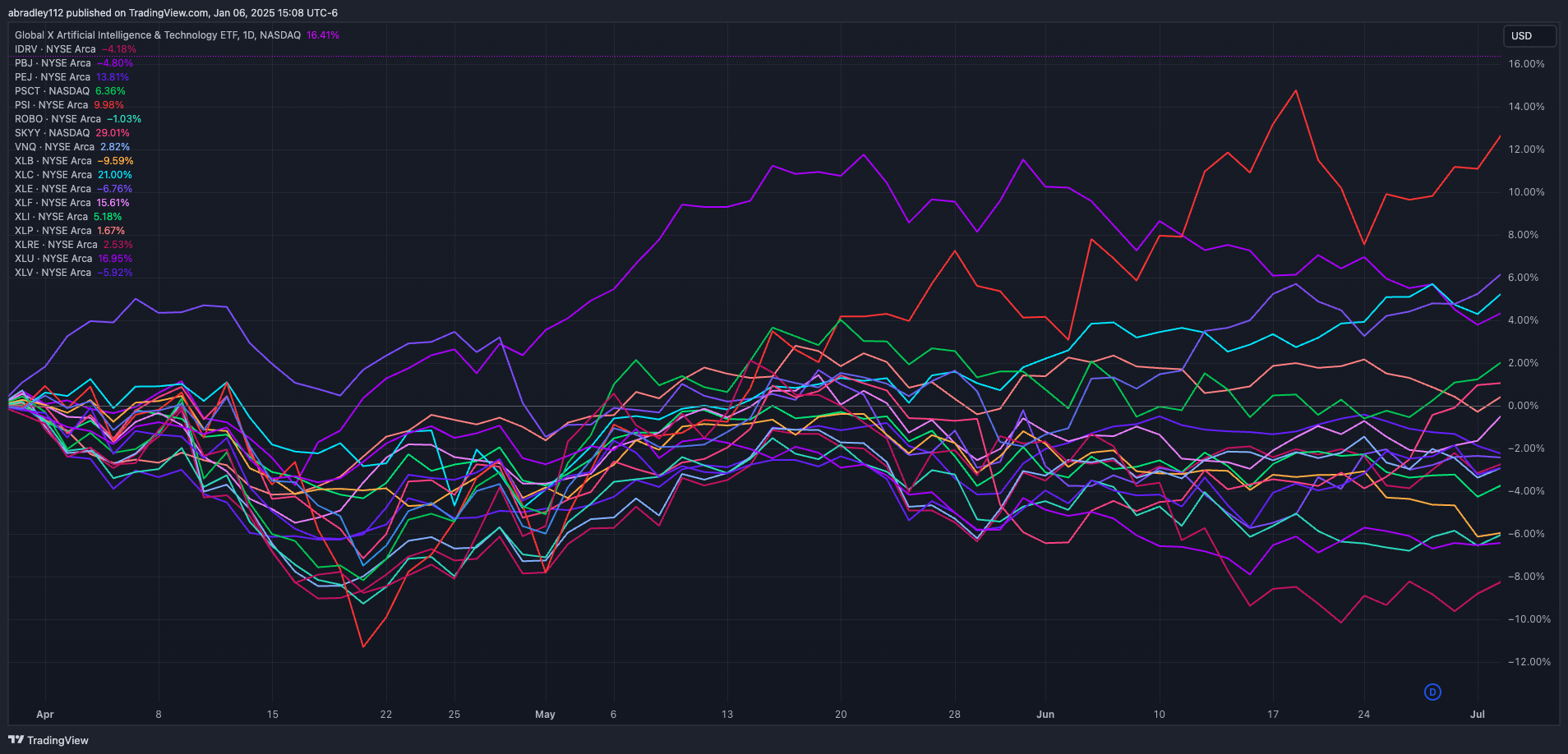

I put together 18 ETFs across multiple sectors and gave them a weight based on how risky I wanted the portfolio to be. It’s been performing fairly well, and while it hasn’t quite kept pace with the market overall, I’ve been happy with it.

I mentioned this before but I’m expecting to underperform the gains of the market overall in good financial times, but suffer fewer losses in more tumultuous financial times. Read on to see how it’s performed over the last 3 months.

Quarter Over Quarter Percentage Changes

Since it’s inception, my portfolio is up 23.5%; while the S&P is up 43% over the same time period. Over just the previous quarter, I’m down nearly 1% (-.7%), with the S&P being up 4%. The market took a bit of a hit this quarter, and my portfolio reflects that.

Given their weights, XLU and XLP gave me the most gains this quarter, gaining 17% and 15% respectively, however ROBO and XLB each suffered 6% losses. Couple that with the rest of the ETFs either having low or negative gains, and overall I roughly broke-even.

Down markets are buying opportunities, though, so I was able to get more shares in IDRV, PBJ, PSCT, VNQ, XLP, XLRE, and XLU.

Conclusion

Like I said, though, I don’t fully expect to keep pace with the market overall, so I’m fine with the performance. I was able to add a decent amount of shares to my account this quarter, which will lead to compound gains in the future.

Thanks for reading! Let me know in the comments if you’ve got any questions or thoughts on my portfolio. Also, don’t forget to check back in a couple months to see the next update on the portfolio; it’s going to be fun watching it grow!